I like to think that despite being wealthier than most Americans, I remain immune to materialistic desires. I drive a 17-year-old Honda Accord and wouldn’t know designer clothes if you wrapped me in them, head to toe. But it turns out that I’m wrong. I’m not above materialism despite my wealth and social status. I’m immune because of it. Since I don’t need to signal my social value, I can save my money for other purposes.

In places with great income inequality, those people with lower incomes live under great social stress. Their low position in the social hierarchy is more obvious and more consequential. In response, some poor people purchase the kinds of good that create the impression that they have social resources to spare, even when they are cash-strapped. And people living in low income neighborhoods – the ones who are relatively well-off compared to their neighbors – are nevertheless worried that they’ll be misperceived as resource poor. So they purchase expensive and conspicuous goods, to make sure their resources are visible to outsiders.

As an example of this behavior, researchers recently examined Google search trends across the U.S., and found that people in states with relatively high income inequality were more likely to search for luxury brands than those in other states. Looking for the latest from Ralph Lauren (who, I discovered, manufactures overly expensive clothes)? The frequency of such Google searches is higher in Mississippi than Iowa (relative to more generic Google searches, like for “weather” ), in Mississippi than Iowa, and in New York than Nebraska. Basically, people living amidst greater income inequality are more interested in luxury goods.

(To read the rest of this article, please visit Forbes.)

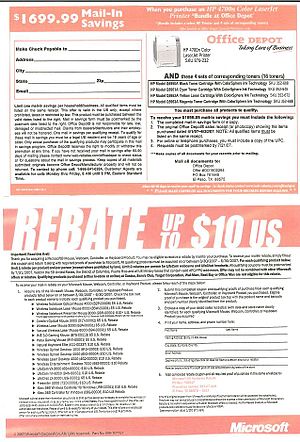

The Ethics of "Manipulative" Product Rebates

In two recent posts, I have posed questions about the appropriateness or inappropriateness of manipulating consumers by taking advantage of behavioral phenomena beyond their awareness. We behavioral scientists know things about human nature that most people haven’t learned. That is why we can fill books with visual illusions – our understanding of how the brain processes visual data allows us to play tricks on people. Indeed, this idea of visual illusions influenced the thinking of early behavioral economists and psychologists, who uncovered what they called “cognitive illusions.” (Daniel Kahneman discusses this topic in his book Thinking Fast and Slow.)

In two recent posts, I have posed questions about the appropriateness or inappropriateness of manipulating consumers by taking advantage of behavioral phenomena beyond their awareness. We behavioral scientists know things about human nature that most people haven’t learned. That is why we can fill books with visual illusions – our understanding of how the brain processes visual data allows us to play tricks on people. Indeed, this idea of visual illusions influenced the thinking of early behavioral economists and psychologists, who uncovered what they called “cognitive illusions.” (Daniel Kahneman discusses this topic in his book Thinking Fast and Slow.)

In one recent post, I posed the hypothetical case of a savvy businessman who created a snow pants rebate plan that simultaneously increased sales of snow pants while minimizing the chances that consumers would claim the rebates. (Why snow pants, you ask? Because I was born and raised in Minnesota, where we take snow pants quite seriously!) The businessman realized that a combination of the planning fallacy accompanied by a dash of unrealistic optimism, mixed with a pinch of self-regulatory failure and… Voilà: people would overestimate the odds of claiming the rebate in time… (Read more and view comments at Forbes)

Can a $20 Rebate Amount to Highway Robbery?

Steven Johnson was a rising star at the NordicWear Company, even before that brutal winter of 2002. But then, thanks to a rebate program he instituted for their new line of snow pants, he rocketed up the corporate ladder.

Steven Johnson was a rising star at the NordicWear Company, even before that brutal winter of 2002. But then, thanks to a rebate program he instituted for their new line of snow pants, he rocketed up the corporate ladder.

His plan was brilliant in its simplicity. Late in the previous winter, he ran a series of rebate deals in small markets across northern Minnesota and Wisconsin. In some towns, he gave customers a week to turn in their receipts for a rebate. In others, a month. In yet others, he was generous enough to give them six months. He also varied the dollar amount of the rebate, and the amount of paperwork customers needed to turn in to claim their rebates. Informed by the result of these experiments, Johnson identified the rebate sweet spot:

The rebate deal that maximized profits by . . . (Read more and view comments at Forbes)

Brain Control and Consumer Behavior

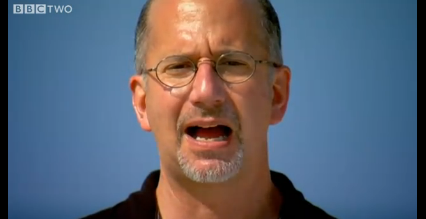

I teach a course on consumer irrationality and market failure at the Fuqua School of Business. I open up one of my lectures with a brief video demonstration of what psychologists call “the McGurk effect.” (See an example here.) In the video, a man makes the sound “ba ba ba.” About half of my students invariably identify the sound accurately. But the other half? They swear on their mothers’ graves that he said “fa fa fa.”

I teach a course on consumer irrationality and market failure at the Fuqua School of Business. I open up one of my lectures with a brief video demonstration of what psychologists call “the McGurk effect.” (See an example here.) In the video, a man makes the sound “ba ba ba.” About half of my students invariably identify the sound accurately. But the other half? They swear on their mothers’ graves that he said “fa fa fa.”

Why such strong disagreement? Because that latter half of my class listened to the videos with their eyes wide open, and their eyes told their ears what to hear. You see, the people who made the video spliced in the sound of the man saying “ba, ba, ba” over a video of him saying “fa fa fa.” Confronted with this inconsistent sensory evidence, these students’ brains tried to come up with a coherent picture of the world. As a result, they mistakenly believed the man was saying something he wasn’t saying… (Read more and view comments at Forbes)

When Aggressive Medical Care Was More Dangerous Than Assassin's Bullets

Dr. Smith Townsend knelt on the filthy train station floor, the patient lying in front of him with a bullet wound in his back. The patient was clinically stable for the moment, so Townsend turned his attention to the wound, convinced a quick removal of the bullet would offer his patient the best chance of survival. Fueled by an action imperative, Townsend took his index finger—ungloved, unsterilized, probably only moments earlier… (Read more and comment at Forbes)

Dr. Smith Townsend knelt on the filthy train station floor, the patient lying in front of him with a bullet wound in his back. The patient was clinically stable for the moment, so Townsend turned his attention to the wound, convinced a quick removal of the bullet would offer his patient the best chance of survival. Fueled by an action imperative, Townsend took his index finger—ungloved, unsterilized, probably only moments earlier… (Read more and comment at Forbes)