Bundling Hospital Pay Without Bungling Patient Care

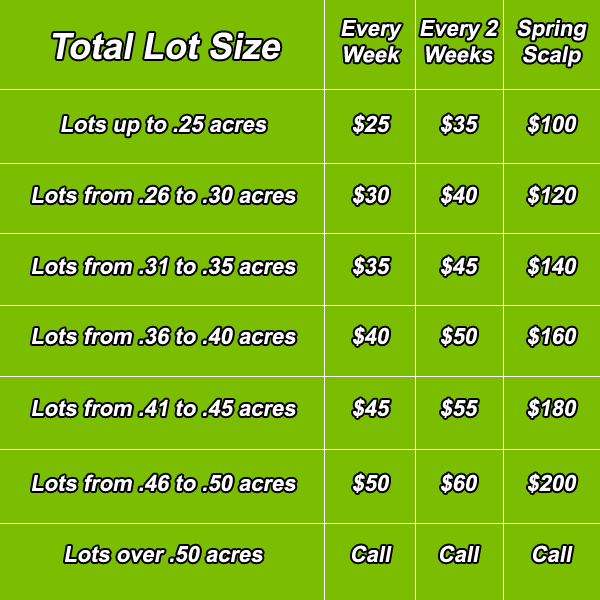

Paying someone to mow your lawn is a pretty straightforward affair. Ryan the lawn guy will look at the lawn size and maybe the hilliness of your yard and you’ll settle on a price for mowing and trimming it. When you decide to contract for Ryan’s services on a more regular basis, payment might get a little more complicated. If you pay Ryan every time he mows your lawn he might mow it more often than necessary. But that problem is easily addressed by paying him a fee to take care of your lawn for the entire growing season.

Paying a hospital to care for someone who had a stroke is not so straightforward. Imagine you are an insurance company and you decide to pay the hospital for each day the patient is in residence. With that kind of payment scheme the hospital visit might drag on indefinitely. Indeed several decades ago insurance companies in the United States primarily reimbursed hospitals on a “per diem” basis, cool kid lingo for per day. Incentivized by this reimbursement scheme, the length of stay in American hospitals was often surprisingly long for even relatively mild conditions. Think of the parallel to lawn care: pay per mowing and you can expect lots of mowings!

Healthcare payers have developed several methods to overcome this per diem/per mowing problem. I will explain these methods shortly, but first the bottom line. Figuring out how to pay for hospital care is a hell of a lot more complicated than figuring out how to pay your lawn service.

To combat the unintended consequences of per diem payment coverage, Medicare switched to per diagnosis payments in the 80s, and the insurance companies followed shortly thereafter. Under this DRG program, a hospital taking care of a patient with a severe stroke would receive appropriate payment for that diagnosis, while a hospital taking care of someone with mild pneumonia would receive a smaller payment appropriate for the typical costs of paying for that condition. Following the implementation of this type of prospective payment, length of stay in American hospitals plummeted. In response, much of medical care was shifted to post-acute care, to rehabilitation hospitals, for instance, for stroke patients, or to outpatient clinics for people with pneumonia. These non-hospital services were not covered by the diagnosis-based DRG payments, so healthcare providers had little incentive to practice parsimoniously once their patients left the hospital.

Enter bundled payments. In 2013, the Center for Medicare and Medicaid Services, henceforth CMS, launched its Bundled Payments for Care Improvement Initiatives, henceforth BPCI (in case your life needs more acronyms). In the BPCI, CMS identified 48 clinical conditions that qualify for bundled payments, meaning participating healthcare providers would receive payments designed to cover not only hospital care for the condition in question, but money to pay for all healthcare related services they receive for the next 30 days. Unsurprisingly, not all hospitals are eager to join this program. For starters, the hospitals have to be financially integrated with post hospital providers. If patients receiving stroke care at Our Lady of Acute Care Hospital receive post-acute care from a hodgepodge of rehabilitation facilities, many of which have no connection to the hospital, then coordinating payments will be a disaster. (To read the rest of this article, please visit Forbes.)